Starting your online business is a complicated process for a lot of reasons.

Aside from figuring out what you’re going to sell and who you’re going to sell it to, you also need a plan for taking your business to market and growing your brand. There are checkout systems to set up, transaction fees to think about, and advertising costs to consider too.

On top of all that, the more time you spend in the ecommerce landscape, the more it can feel like you’re learning a new language. Terms like “POS systems”, PCI, and merchant account can leave any entrepreneur in a spin.

One of the common terms that you’re likely to come across as you build your business, is a merchant service provider.

To create a successful strategy online, you’re going to need a payment processing solution, and a merchant service provider can help with that.

Today, we’re going to help you bypass the confusion around merchant service providers once and for all. Here’s your no-nonsense answer to the question: “What is a Merchant Service Provider?”

Merchant Service Provider Definition

To know what a merchant service provider is, you first need to understand the term merchant services. As a business owner that sells products or services online, you’re a merchant. Merchant services are the hardware and software solutions that enable your transactions.

For instance, credit card processing tools, POS solutions that accept debit cards, and online forms for card transactions are all kinds of merchant services.

Before the age of eCommerce, merchant services were an exclusively offline concept. You used to take money from a card with a piece of hardware, and you would track your purchases that way. Your POS would send money to your bank account, and there was no need for any complicated payment gateway solutions.

Now, if you want to accept payments from around the world, you need more than just a point of sale system. Merchant services have evolved for the digital age, allowing for virtual terminal products, and credit card payments that happen entirely online.

Some people even include inventory tracking tools under the umbrella definition of merchant services because they help companies with managing their online sales.

A merchant service provider or merchant account provider is a company or service that gives you access to all the tools you need to handle those all-important transactions. Your merchant service provider is responsible for everything from your point of sale, to your payment gateway.

Defining the Different Types of Merchant Service Provider

So, merchant service providers are companies that help you take visa and credit card payments online or offline. Seems simple enough, right?

Where things start to get complicated for today’s business owners, is that there are various different kinds of merchant service provider. Different companies offer different solutions. Some are designed for small business owners, while others support larger companies and franchises.

The most common kinds of merchant service provider often fall into a few key categories. These include:

Merchant account providers

A merchant account provider generally offers you simple credit card processing services so you can ensure that you’re getting money when a customer pays you online or offline. These companies often provide processing services that work with some of the largest credit card networks, like American Express, and Mastercard. The amount you spend on your merchant account providers will depend on what kind of processing services you want to use.

Payment Service Providers

Payment service providers offer an alternative solution for companies that want to accept various payment methods. Smaller organizations don’t always need a full merchant service provider to accept credit or debit card payments. Payment service providers like Square or PayPal make it easier to accept online payments without a dedicated account. Instead, your account is aggregated with a number of other merchants, and you don’t get a unique ID number.

PSP accounts are excellent for companies that want to keep costs low and technology simple. However, payment service providers are also more likely to freeze your account without warning.

Payment Gateway Providers

As online sales and eCommerce have become more popular, payment gateway providers are also gaining more traction. These solutions allow you to accept online payments. You may get a merchant account as part of the deal, or you might not. Some companies can offer gateway-only services which make it easier for companies to access more flexible solutions for online payment management.

What are the Features of Merchant Service Providers?

The features that you unlock with a merchant service provider account will depend on the kind of service you choose. Some companies only offer you processing services, while others help with things like PCI compliance and protection from chargeback fees.

Most merchant service providers will give you a wide selection of service and products that make it easier to run your store online. All businesses need to acquire either a merchant account or a payment service provider account to take payments online. However, it’s up to you to determine which strategy is the bet for you.

Some of the most common features of a merchant service provider account include:

- A merchant account: Merchant accounts are essential accounts that act as a middleman between your customer’s bank account, and your business bank account. Full merchant accounts give you an ID number that help you to protect against issues like fraud. If you have a payment service provider account, then you can also accept payments, but you don’t get the same level of support or protection. Your merchant account is where the money from your customer’s payment card will be stored before they’re deposited into your bank account.

- Credit card terminals: Credit card processors can come in physical, or virtual format. If you’re a retailer with a brick and mortar store, then you may need credit card processors that you can use with customers in person. You can get a card reader from your merchant services account provider. However, payment service providers can sometimes offer terminals too. Square and PayPal have their own card reader options, for instance. Different terminals come with their own unique features. For instance, some will allow you to take contactless or pin-free payments. Others will support payments from smartphones.

- Point of Sale systems: Point of sale systems aren’t the same as card terminals and payment processing hardware. Instead, these solutions combine the functions of your card terminal with a computer display with included software. The software on your POS will help you to manage things like inventory, and analytics. You can monitor your sales, gather information for tax purposes, and more with this technology. Many leading point of sale systems come with add-on options, like receipt printers and dedicated scanners.

- Payment gateways: Payment gateways are another common feature for both merchant accounts and payment service provider accounts. These gateways bridge your service provider’s processing networks with your website so that you can take payments over the internet. Sometimes, you’ll need to pay a monthly fee for your payment gateway if you want to access this feature. This is on top of any processing fees that you need to spend too.

Other Features of Merchant Service Accounts

Merchant service providers offer a combination of security and convenience to businesses looking to sell products and services online. Without the right service provider, you wouldn’t be able to build a successful store, because taking payments would be impossible.

Some of the leading merchant service providers offer a lot of extra peace of mind for their customers too, by allowing for better payment security. Your merchant service provider can help with things like PCI compliance, which puts the minds of your customers at ease. Because the cardholder data stored by your business is encrypted, it stays secure.

Merchant service accounts can also offer protection for you in the form of chargeback protection. This means that when a dispute is made about something you sold to a customer, the transaction is reversed, and the customer gets their money back. Chargeback means that you don’t have to waste time on arguments with suppliers, or customers.

Other features of merchant accounts might include:

- Virtual terminals: These are software solutions delivered over the cloud. Often, they can turn iPads, tablets, or computers into portable point of sale systems. You can enter transactions into the system manually, or use a USB connected card-reader. If you tend to visit festivals or sell your products with pop-up shops, this can be helpful.

- Online shopping carts: Some merchant service providers and payment service providers can help with your shopping cart software too. Most of the time, your eCommerce site building tool will be the best place to go for shopping cart software. However, it’s worth making sure that your cart has compatibility with your merchant service provider before you invest.

- Merchant cash advances: If you need extra money to launch your business, then a merchant service provider can sometimes give you access to extra cash. In return, you might give a portion of your earnings back to the company that you borrow from until you repay what you owe. Merchant advances are different to loans because there isn’t a set amount you need to repay every month.

How to Choose a Good Merchant Service Provider

If you’re on the hunt for a merchant service provider or payment service provider to support your business, it can be difficult to determine what you really need. There are a lot of different options out there, and different kinds of service provider to choose from.

Ideally, you’ll want to start by thinking carefully about the kind of business you want to run. If you’re only making a few thousand dollars in sales every month, then working with a payment service provider might be easier for you than using a full merchant service provider.

A few things to consider when examining your options may include:

- Fees and pricing structure: Membership fees, interchange plus, and flat-rate fees are all things that you’ll need to think about. Some service providers have tiered pricing structures and extra transaction rates to consider.

- Ease of use: You need to feel confident using the technology available from your merchant service provider so that you can get the most out of it.

- Features: What kind of extra features can you unlock with your merchant service provider? Are there reporting tools for tracking your sales, and various payment gateway options?

- User reviews: How have other companies responded to the service provider in the past? Does the company have a good reputation for customer support.

- Security: How does your merchant service provider keep your transactions secure? How easy is it to access your money and deal with complications?

6 of the Best Merchant Service Providers

To help you make the right decision with your merchant service provider, we’ve searched through some of the market leaders to bring you these top performers.

1. Square

Square is one of the best merchant services providers for retailers who want to sell their products online and offline. With Square, you get a payment processor, a range of tools to help you start selling quickly, and even access to hardware, like point of sale systems.

Square is perfect for smaller companies who are just starting out, because it comes with a quick-and-easy set-up, no massive contracts, and no extensive monthly fees. You can even get a free mag stripe reader for your offline selling. When you’re selling online, Square can help you to build an engaging presence with a free website builder too.

Pricing

Pricing for Square is simple, with a single tier for everyone. For any swipe, dip or tap payments, the cost is 2.75% of your transactions. Keyed-in transactions are sometimes more expensive, costing up to 3.5% of your revenue.

Pros

- Free website builder

- Great for offline and online selling

- Easy way to process credit and debit payments

- Simple pricing structures

Cons

- Higher transaction fees for some credit card transactions.

2. PayPal

PayPal is one of the most popular payment service providers on the market today. There’s something for everyone, no matter the size or style of business that you run. With PayPal, you can take online, offline, or mobile payments. You can also access PayPal hardware such as swiping systems for taking payments on the move.

The basic service available from PayPal is better for companies with minimal payment needs. PayPal is particularly well suited to eCommerce companies, even though there are merchant accounts and point of sale systems to explore.

Pricing

The price of your PayPal experience will depend on the kind of features you want to access. Transaction fees start at 2.9% plus 30 cents, which make PayPal a competitive option for online payments and transactions.

Pros

- No monthly fees

- Excellent for online transactions

- Great for getting payments from around the world

- Well-known brand offers credibility

Cons

- Limited offline features

3. Payline Data

There are tons of different merchant service providers out there to choose from. Companies like Fattmerchant, payment depot, and TSYS make getting started with your business a lot easier. Payline Data is a merchant service that promises to simplify your credit and debit card transactions.

There are a variety of plans available from Payline data, including those specifically suited to certain industries. For instance, you can get Payline Medical for the healthcare field. The Payline gateway is available as a plugin for basic business website functionality.

Companies can also access virtual terminals with Payline.

Pricing: Payline offers transparent pricing and competitive rates for companies. A swiped transaction falls under the category of Payline Start, which has a fee of $10 per month, and 2% per transaction. Keyed in and online transactions cost $10 per month under Payline Connect, with a 3% transaction fee and 20 cents for every payment.

Pros

- Quick same-say approvals

- Transparent pricing structure

- Flexible and friendly design

- Integrated business loan service

Cons

- Monthly fees

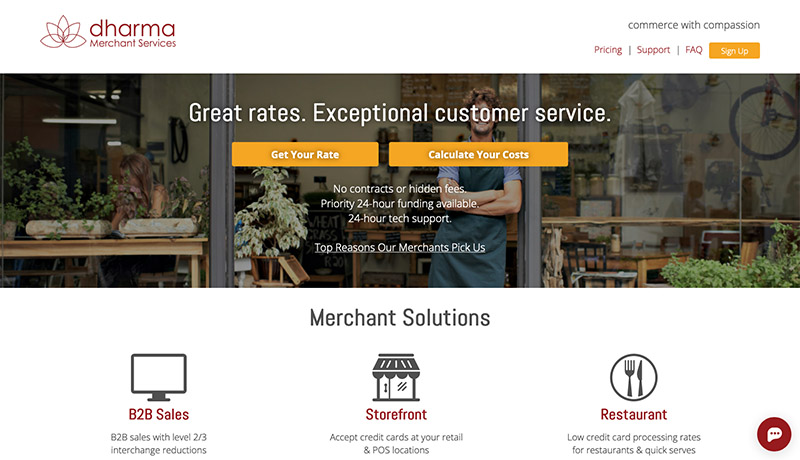

4. Dharma

Dharma is a leading merchant services company offering plenty of great functionality to growing companies. If you’re looking for a convenient and reliable credit card processing company then this could be the perfect brand for you.

Dharma is intended for larger companies, with a pricing structure that’s suitable for companies processing around $10,000 in sale per month. This merchant services provider offers constantly fair and predictable pricing, with all standard rate information provided on the website.

Dharma probably isn’t the right MSP for you if you’re running a high-risk business, however. Along with merchant accounts, Dharma also offers payment gateways, and credit card terminals.

Pricing

Dharma Merchant Services offers one of the most transparent pricing structures, with interchange-plus pricing. There’s a $20 monthly feel for retail, ecommerce, and restaurant companies. Retail and restaurant interchange prices are 0.15% plus 7 cents for every transaction. Virtual rates are 0.20% plus 10 cents for each transaction. If you sell more than $100,000 per month, your fee is only $15 per month, and the interchange plus is 10% plus 5 cents for every transaction.

Pros

- Excellent for high-volume sells

- Interchange plus pricing

- Discounted pricing for certain nonprofit companies

- Good transparency and customer support

- Month-to-month billing

Cons

- Not ideal for smaller companies

- No support for high-risk companies

5. Payment Depot

Finding the right merchant service accounts provider is a lot like looking for the best provider in the payment card industry. Everyone has their own needs. Payment Depot is a merchant service provider that offers a membership pricing model. You pay a flat monthly fee and get competitive rates on every transaction.

Payment Depot allows companies to easily accept all of the major credit cards, as well as apple pay, Google pay, MasterCard, discover, and more. This service is best suited to companies that process a significant amount of transactions each month – usually around $20,000 or more.

Pricing

Payment Depot’s membership model comes with a range of pricing options. The lowest fee is $49 per month, and the cost can go up to $199 per month depending on the size of your company and the features that you want. When you’re set up with your plan, you pay the interchange fees for your transactions without a markup. The only extra expense is a flat fee that could be 5 cents to 15 cents.

Pros

- No percentage markup

- Wide range of fee options

- Accepts all major payment methods

- Convenient and easy to use

- Very good customer support

Cons

- Not ideal for small companies

6. Quickbooks Payments

QuickBooks is best known for its invoicing and accounting services. However, with QuickBooks payments, you can also handle your transactions online and offline too. There’s a free trial for beginners, and you can also add in other Quickbooks functionality to manage your sales and finances for tax purposes.

QuickBooks payments makes it easy to manage everything from the financial side of your business in one space. You can even receive cash transfers through ACH. QuickBooks is very similar to PayPal and Square in its pricing structure, because there are no monthly minimums and you can start using the payment processing services as soon as you like.

Pricing

QuickBooks Payments offers a simple and straightforward payment structure. The rate you pay depends on the type of sale you’re processing. For simple start, you spend around £12 per month on your transactions, and there’s a basic transaction fee. Quickbooks can also customize an interchange plus plan for you if you process more than $7,500 per month.

Pros

- Great range of bonus features available

- Convenient monthly pricing

- Easy to manage your whole financial strategy in one place

- No monthly minimum

- Small or large business ready

Cons

- Expensive with extra features

Understanding Merchant Service Providers

There a lot of terms that can be confusing in the business world, from EMV to acquirer and merchant service provider. However, once you get to grips with what a merchant service provider is, and why it’s so essential for your company, you can begin to look for the solution that’s right for you. There are tons of options out there, from Authorize.net and first data, to PayPal and Square. The service that you choose will depend on your business needs, and the kind of transactions you manage.

Remember, not every company will need a full merchant services account. Retail-only businesses might just want a reliable credit card terminal. eCommerce companies might need a payment gateway without the terminals. Every business is different. The key to success is figuring out what works for your company.